Insurance agents and health care advocates say many business owners and self employed remain unaware how to fund their health insurance properly

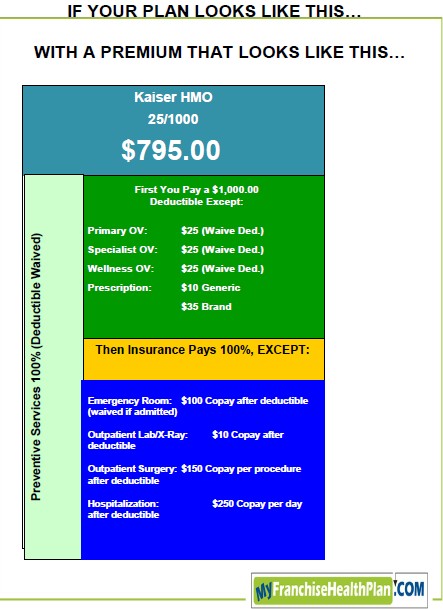

Consider this standard HMO plan, with a low deductible of $1000.00, but an unaffordable monthly rate of $795.00.

(Click on the image to enlarge it.)

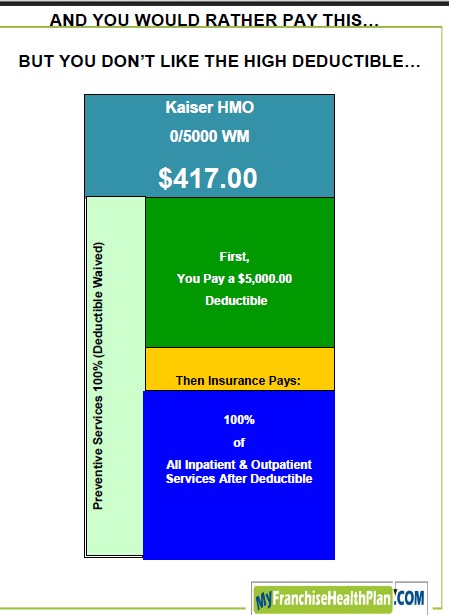

But $800 is just is too much to pay a month. What you really want is something like this, and cut your monthly payments in half.

Now, you have a monthly payment that you can afford of $400.00 but that high deductible may prove an even harder nut to crack.

Is there a combination of plans which would lower the monthly payments, but not increase the deductible?

Yes.

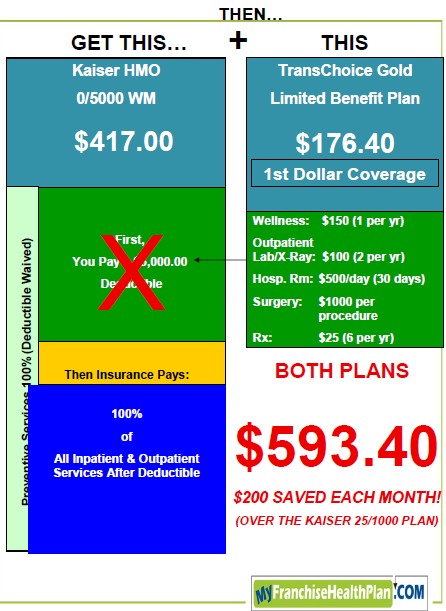

The answer is that with some limited benefit plans you can bundle them to create a new HMO to create monthly rate, lower than $900, but higher than $400 and "not have to worry" about the high deductible.

For example, using the Trans Choice Gold limited benefit program, you can construct the following HMO.

(Click on image to enlarge it.)

By paying a small premium to the limited medical benefit program and bundling it with a major medical plan, you can fund most of the deductible with insurance dollars instead of your own dollars.

Assuming that all the other requirements are met, this plan would get the health care tax credit - where the limited benefits program by itself would not.

Great way to lower your monthly payments, increase your benefits, and access the health care tax credit.

I was searching for how the new healthcare law will affect my small business and came across this article. This is very useful information! I had never heard of first dollar coverage or combining 2 policies like this to save on costs. I noticed that you are in California. Do you know if this can be done in North Carolina?

Denise Chew

owner

Enviro-Equipment, Inc.

http://www.enviroequipment.com

The technique of combining a High-Deductible Health Plan (HDHP) with a complimentary benefit program came out of a need by individuals and business owners to reduce their premiums, yet still retain many of the essential benefits of comprehensive health coverage.

That need gave birth to a type of limited benefit plan called a �Gap Plan�.

This plan provides certain limited first-dollar benefits on an indemnity basis.

That is, a fixed-dollar amount is paid to you for each covered service.

When this plan is combined with a HDHP, much of the cost that would ordinarily be borne by the insured before they have satisfied their deductible is now paid by the Gap Plan.

In addition, because the funds are paid directly to you and you pay the provider or use the money to reimburse yourself, you are remain compliant with the requirement that services rendered before the deductible is met be paid by the insured.

The premium for the combined Gap Plan and HDHP falls approximately midway between the cost of a $1000 deductible plan and a $5000 deductible plan.

Yet even with a $1000 deductible plan, you do not get as many first-dollar benefits as you do in a Gap/HDHP combination.

Only a handful of insurance companies offer this coverage and an even small number of them are A-rated by A.M. Best.

We offer this program to IAFD members, including IAFD suppliers, attorneys, or franchisees through their associations and only use A-Rated carriers.

If you are interested in receiving more detained information about this program, please send us your employee census, business name and address, business type, current plan design premium and renewal date to [email protected].

I will be happy to analyze your current program and see how much you can save.

Steven Chapkin

I won't denied, I was a bit unaware of the calculation and payment concerning my small business employees about the health care newly amended law. Thanks for that helpful sharing.

Glad we could help.

Very interesting post thanks for writing it I just added your website to my favorites and will be back. www.flipxinsure.com

This was very informative. The above techniques are quite help to reduce monthly payments as well as to increase benefits. Thanks for sharing..